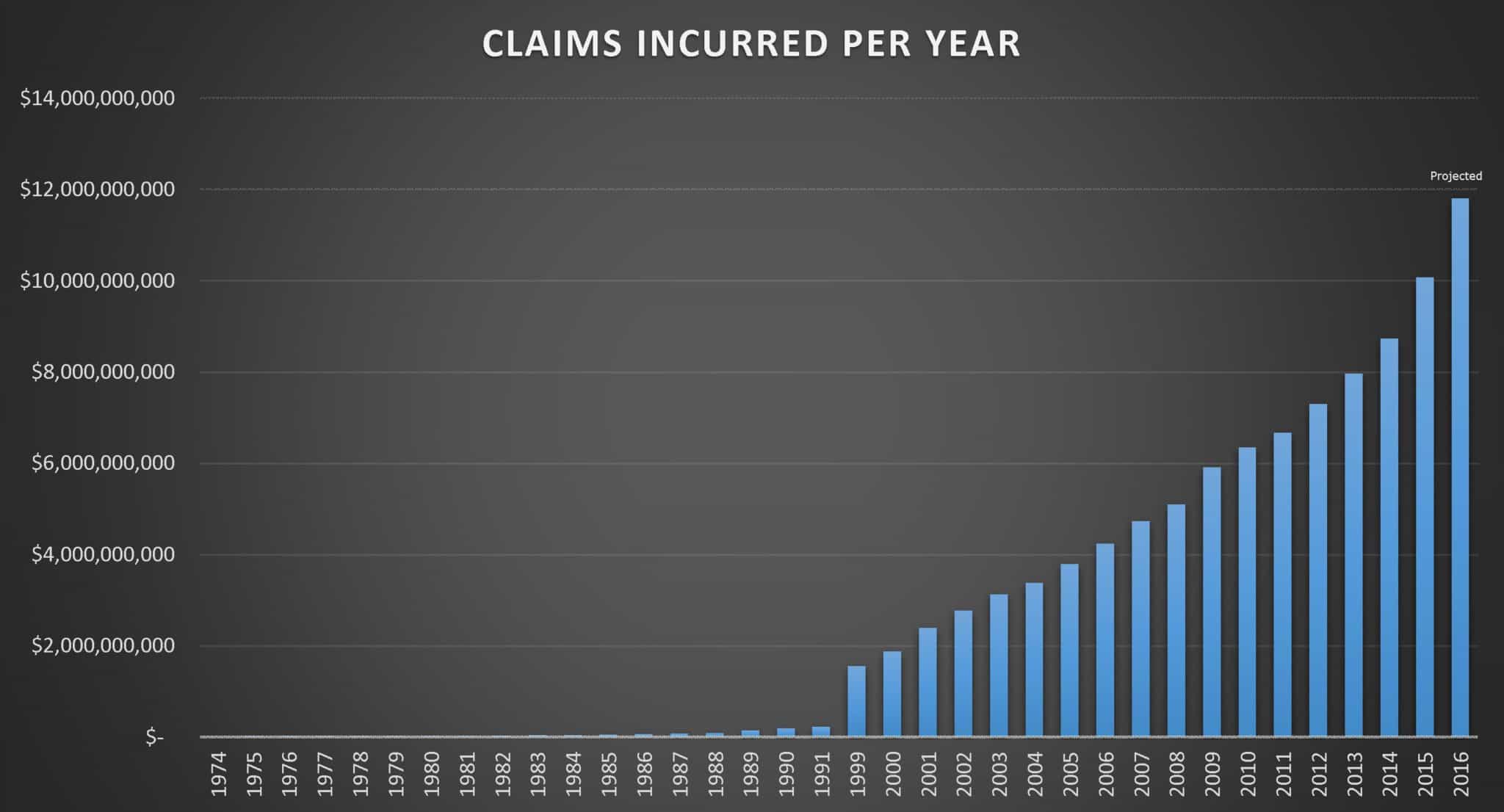

Long Term Care Insurance Claims Exceed $10 Billion

For the first time ever, long term care insurance claims exceed $10 BILLION in one calendar year!

In 2014, long term care insurance claims were over $8.5 BILLION.

253,922 policyholders and their families were helped that year.

In 2015, long term care insurance claims topped $10 BILLION.

268,411 policyholders and their families were helped that year.

Claims are trending toward $11.8 BILLION for 2016.

(The exact claims total for 2016 will be released in the second half of 2017.)

It took from 1974 to 1992 for long term care insurance claims to reach the cumulative total of $1 Billion. Around 1996, long term care insurance claims surpassed $1 Billion in a calendar year for the first time. Today, long term care insurance claims exceed $1 Billion every six weeks!

Long term care insurance claims now exceed $1 Billion every six weeks! Click To Tweet

Nearly all long term care insurance claims are paid (contrary to what is often posted on the internet). The headline: “Long Term Care Insurance Claim is Denied!” gets a lot more clicks than “97% of Long Term Care Insurance Claims Are Paid!”

As part of a 28-month study funded by the U.S. Department of Health & Human Services, roughly 1,400 long term care insurance claimants were asked a series of questions. Almost all of those who filed a claim were either approved (89%) or awaiting a final decision (7%); only 4% had been denied.

As part of a 28-month study funded by the U.S. Department of Health & Human Services, roughly 1,400 long term care insurance claimants were asked a series of questions. Almost all of those who filed a claim were either approved (89%) or awaiting a final decision (7%); only 4% had been denied.

When claims were denied, it was usually because the claimant did not meet the policy’s benefit eligibility criteria.

Because individuals were interviewed about every four months, they were able to learn whether those who were initially denied benefits ultimately received them over the course of the study. The claims denial rate dropped from 4% to 2.4% after one year.

Study for the Dept. of HHS found that 97.6% of long term care insurance claims are paid. Click To Tweet

More and more people see the value of owning long term care insurance as a result of seeing their relatives’ claims being paid. They see first-hand the benefit the policy brings to their relative and decide they want long term care insurance, too. According to a recent study, “individuals with LTC insurance receive on average 35 percent more hours of care than those without a policy.” (AHIP: The Benefits of Long Term Care Insurance)

In most states, 13 different insurance companies are now actively selling new long term care insurance policies. Two highly-rated companies now offer policies with unlimited benefits (no lifetime cap). These companies also offer policies where you’re covered for life but the premiums stop after 10 years.